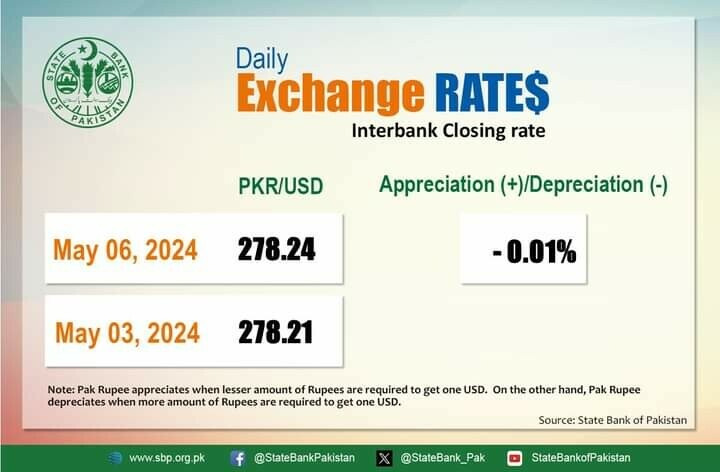

The Pakistani rupee saw marginal stability, dipping by only 0.01% against the US dollar in the inter-bank market on Monday. At the close, it settled at 278.24, marking a slight decrease of Re0.03 compared to the previous rate, as reported by the State Bank of Pakistan (SBP).

During the prior week, the rupee experienced a modest uptick against the US dollar, gaining Re0.18 or 0.06%. The local currency concluded the week at 278.21, a slight improvement from the previous week’s closing rate of 278.39, according to SBP data.

In significant news, the International Monetary Fund (IMF) is anticipated to visit Pakistan this month for discussions on a new program. This development comes ahead of Pakistan’s commencement of its annual budget formulation for the upcoming financial year.

Pakistan recently concluded a short-term $3-billion program, which aided in averting a sovereign default. However, Prime Minister Shehbaz Sharif’s government emphasizes the necessity for a fresh, longer-term program.

The IMF stated, “A mission is expected to visit Pakistan in May to discuss the FY25 budget, policies, and reforms under a potential new program for the welfare of all Pakistanis,” in an email response to Reuters.

Additionally, Finance Minister Muhammad Aurangzeb mentioned that the IMF mission is slated to arrive in Pakistan within the next seven to ten days.

On the global front, the US dollar remained relatively stable on Monday following a soft US jobs report, fueling speculations of potential Federal Reserve rate cuts. Meanwhile, the yen weakened slightly at the start of the week.

Market data revealed a slowdown in US job growth for April, with annual wage increases dipping below 4.0% for the first time in nearly three years. This prompted optimism regarding a “soft landing” for the US economy by the central bank.

Market sentiment now anticipates 45 basis points of cuts this year, with a rate cut in November already fully priced in. The dollar index, measuring the US currency against six peers, stood at 105.12, after touching a three-week low of 104.52 on Friday.

Oil prices climbed on Monday, driven by Saudi Arabia’s decision to increase June crude prices for most regions and uncertainty surrounding a Gaza ceasefire deal. Brent crude futures rose by 73 cents to $83.69 a barrel, while US West Texas Intermediate crude futures reached $78.95 a barrel, up 84 cents.

Last week witnessed significant declines in both futures contracts, marking their steepest weekly losses in three months, amidst weak US jobs data and speculation surrounding Federal Reserve interest rate adjustments.