Economic jargon can often confuse people, and in Pakistan, politicians sometimes simplify complex statistics to create a misleading narrative. This was evident when the average monthly inflation rate for September was released, showing a 44-month low.

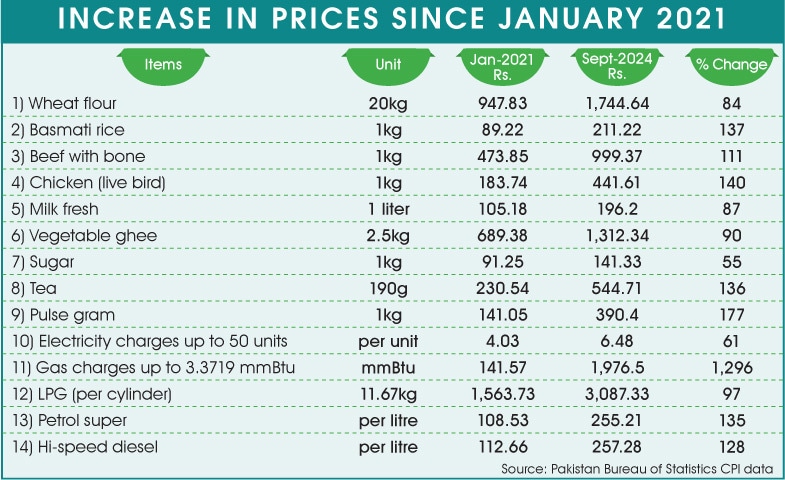

Celebrations erupted among government officials and party members, who claimed that inflation was under control and prices were falling. The reported average monthly inflation rate for September was 6.9%, the lowest since January 2021. However, a closer look reveals that over the past 44 months, cumulative inflation has increased by 83.13%, affecting the prices of various consumer goods.

While the ruling coalition has used this drop in inflation to argue that the cost of living is decreasing, it’s important to unpack this claim. The average inflation rate for previous years was significantly higher: 9.2% for January to June FY21, 12.5% for FY22, and a staggering 29.18% for FY23. This data suggests that prices have generally risen since January 2021, contradicting claims of a significant decrease.

Inflation in Pakistan is measured using the Consumer Price Index (CPI). Currently, we are experiencing disinflation, which means that while the rate of inflation is slowing, prices themselves are not necessarily falling.

Misleading Claims

Former finance minister Miftah Ismail highlights that politicians often create confusion around inflation rates. He explains that a slowdown in the rate of price increases does not mean that prices themselves have dropped. The low inflation rate in September was mainly due to a strong base effect from the previous year and declining international commodity prices.

Ismail questions the government’s role in this decline, noting that it has not reduced its own spending. He points out that falling international oil prices, along with high interest rates that dampen demand, have contributed to the situation. He warns that any increase in global oil prices could push inflation back up to 11-12% in the coming months, suggesting that the government’s claims are overstated.

Technicalities of Inflation

Dr. Abid Suleri, from the Sustainable Development Policy Institute (SDPI), agrees that the government’s claim of lower inflation is technically accurate. However, this statistic merely indicates how much prices have changed compared to the previous year or month, not that they have decreased overall. For September 2024, the 6.9% figure represents an increase compared to September 2023.

Former economic adviser Dr. Ashfaque H. Khan clarifies that a decline in the inflation rate does not mean that commodity prices are falling. Instead, it reflects a slowdown in the speed of price increases. He notes that recent stability in the rupee and lower global oil prices, along with good crop yields, have helped keep prices steady.

Issues with Electricity Pricing

One area where the CPI calculation could improve is the inclusion of household electricity and gas consumption. The CPI currently only reflects changes in power bills for low-usage customers, which does not represent the true cost of energy for most consumers. Higher tariffs for those using more electricity lead to significant costs that are not captured in the current index.

Rising Production Costs

Several factors contribute to the rising cost of living, according to Dr. Khan. Over the past few years, energy prices have frequently increased, and the cost of imported raw materials has risen due to currency devaluation. High interest rates further elevate borrowing costs, which adds to production expenses, ultimately affecting consumers.

The decline in purchasing power is prompting calls for higher minimum wages and salaries in both the public and private sectors, which can further increase production costs. Dr. Khan emphasizes that rising inflation erodes people’s purchasing power, placing them under considerable financial pressure.

In summary, while the recent drop in inflation rates is being celebrated, it’s crucial to understand the broader context. The figures should be interpreted carefully to avoid misleading conclusions about the economic situation in Pakistan.